Everyone involved in estate planning needs to think about the implications for life settlement options.

Two pieces of the new tax law, the Tax Cuts and Job Act of 2017 (TCJA), have a significant impact on life settlements: the increased estate tax exemption and the clarification of the income tax treatment for life settlements.

TCJA doubled the estate tax exemption, which, indexed to inflation, in 2018 will become $11.2 million per individual and $22.4 million, with portability, for a married couple. This change further reduces, by about two-thirds, the already small number of estates that will have to pay this tax. It is estimated that now only about 1,800 estates, annually, will be subject to federal estate taxation.

(Related: New Tax Law Enhances Life Settlements Market)

The higher estate tax exemption means that many policies previously bought for estate tax purposes must be reviewed. It could be determined that some of these policies, including second-to-die contracts, may no longer be necessary or wanted. Although tax laws can always change and it might be prudent to retain the policy for reasons other than estate taxes, some policies will likely be surrendered. Before that happens, it is your responsibility to your clients to investigate the possibility of a life settlement as it could provide substantially more value to the policy owner than surrendering it back to the issuing insurance company. Trust officers, tax advisors and attorneys should be contacted to be sure that they are also aware of potential life settlement opportunities resulting from the new law. You want them to know that they can call you to assist them with this transaction.

With respect to income taxation, TCJA retroactively returned the tax treatment to what it was prior to 2009 when the Internal Revenue Service issued Revenue Ruling 2009-13. In that revenue ruling the IRS created a difference in the tax basis for policies sold in a life settlement and policies surrendered to the insurance company.

For policies that are surrendered at a gain, the law has long been that the policy owner’s basis is their cumulative investment in the contract, which is basically the cumulative premiums paid less withdrawals and dividends taken from the policy. But for purposes of a life settlement, the IRS ruled that the basis would have to be reduced by the cumulative cost of insurance charges assessed against the policy.

TCJA rejects the IRS ruling and says policies sold in a life settlement receive the same, more favorable, basis as policies that are surrendered.

In brief, a policyholder (with insurable interest) who sells a policy in a life settlement is generally taxed in three tiers as follows:

1. Amounts received up to the tax basis are received free of income tax;

2. Amounts received in excess of the tax basis up to the amount of the cash surrender value are taxed at ordinary income rates; and

3. Amounts received in excess of the cash value get favorable capital gains treatment.

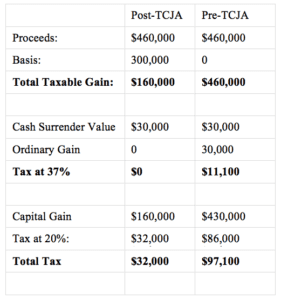

Here is an example comparing the taxation pre and post TCJA of a recent life settlement case using the values (rounded for readability) for a $3 million policy sold for $460,000 with a cash surrender value of $30,000, cumulative premiums of $300,000 and cumulative cost of insurance charges of $300,000.

Note that in this example TCJA reduces the tax liability by two-thirds! And, if the seller is subject to state income tax, the savings would even be greater. To assist you, your clients and their advisors to calculate the tax consequences of a life settlement transaction, we have created a worksheet that can be downloaded here.

With the boost provided by the new tax law, life settlements are an even more important and attractive opportunity that you can provide for your clients and prospects. In addition, it is imperative that you educate advisors so that they can be on the look-out for life settlement situations.

A life settlement is an alternative to lapse or surrender, not an alternative to keeping a policy. If life insurance is going to be terminated, you owe it to your clients to investigate the possibility of a settlement so that you don’t leave money on the table. As we are often heard to say, “it can’t hurt to try – it can only hurt not to!”

By Robin S. Weinberger and Peter N. Katz February 02, 2018 at 05:50 AM www.ThinkAdvisor.com

The Tax Cuts and Job Act passed in December 2017 greatly benefits life insurance settlements. The complete article above outlines the details, but succinctly, there are two key positive impacts:

1) There are more people who may not need their life insurance policies anymore due to the doubling of the estate tax exemption. People who purchased life insurance to cover their estate taxes may now be exempt, making that life insurance policy unneeded or unwanted.

2) Life insurance settlements receive a much more favorable tax basis.

There is not a better time for a client to sell their policy, if that is the best option for them.

Lisa Rehburg

Helping People Benefit from Unwanted/Unneeded Life Insurance Policies

(714) 349-7981